Watch the Latest Fund Webinar

Worcester Fund

What is the Worcester Fund?

The Worcester Fund is an open-ended investment vehicle. We provide accredited investors a diversified equity stake in a fund comprised of multifamily properties in the Midwest and real estate-backed loans. Worcester Investments, a trusted name in Midwest multifamily real estate, manages the Worcester Fund.

Our Investment Strategy

Worcester Investments has a niche focus on the acquisition and management of multifamily real estate in the Midwest. We implement a conservative acquisition approach with a heavy emphasis on buying attractive multifamily properties below their intrinsic market value. We leverage long-time broker relationships, our 90+ employee operations team, and our extensive market expertise to extract maximum cash-flow and long-term value from our assets. The Worcester Fund has a first right of refusal on all Worcester opportunities and participates in those that supply it with robust cash-flow value.

Key Highlights

Zero management fees

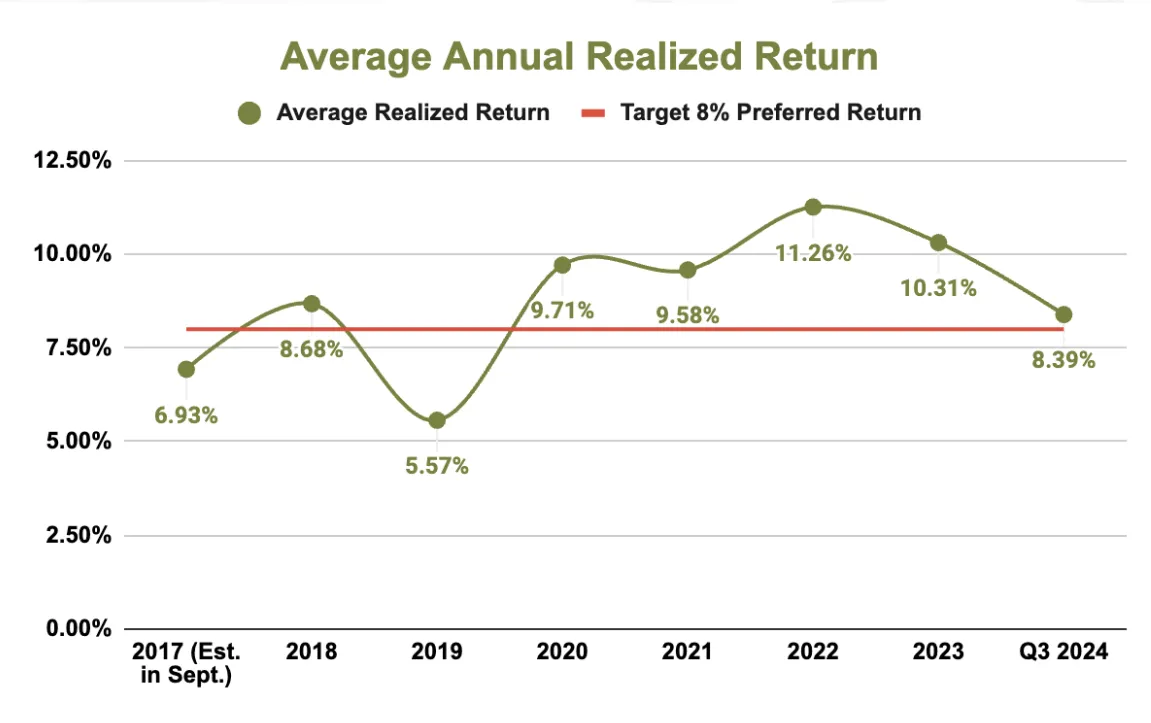

Target total return 8-12% cash-on-cash-return (COCR)

12.64% since inception total return (realized + unrealized gain)

9.20% since inception average annual realized COCR

8% preferred return

$50k investment minimum

Tax incentives through depreciation

Diversification across several assets

Please see the below chart for an illustration of the average annualized realized returns.

Purpose

The Worcester Fund launched in May of 2017 after years of internal planning and external consulting. The Fund’s purpose is to complement our core business of investing in and lending on multifamily real estate in the Kansas City area. The Fund allows our investors to diversify their investment across multiple assets, both in equity investments and private loans. Private loans provide the Fund with reliable interest income. At the same time, equity deals bring upside and property ownership benefits such as principal paydown and depreciation.

Structure

The Worcester Fund does not have to liquidate its assets based on short-term goals because the Fund is open-ended. Thus, it can make decisions based on what is best for the Fund’s long- term performance, assets, and investors.

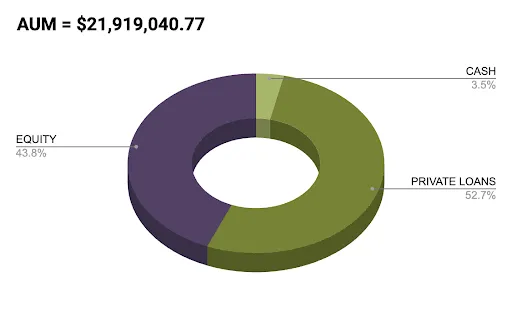

Size

The Fund is currently at just under $22MM in assets. With 60+ investors in the Fund, the average investment is just over $215K.

No Management Fee

To the best of our knowledge, the Worcester Fund is the only fund with no management or related fees. If we charged a 1-3% fee (consistent with the marketplace), we would be out of alignment with our investors’ interests. We only participate when the fund meets or exceeds its return expectations, aligning us with investors (see more below).

Fund Equity Appreciation

While you receive investment income from asset cash flow (realized returns) each month and quarter, your account will also appreciate in value over time due to the fund’s equity holdings. These unrealized returns are reflected in the “market value” of your account, which is reassessed every year and will become realized upon your exit from the Fund.

Distributions

While most funds pay distributions quarterly, the Worcester Fund distributes 5% monthly, and then at the end of the quarter, we “true-up” the Fund and distribute the remainder of the returns. This process means we examine the Fund’s performance and distribute the additional returns based on the fund’s quarterly performance.

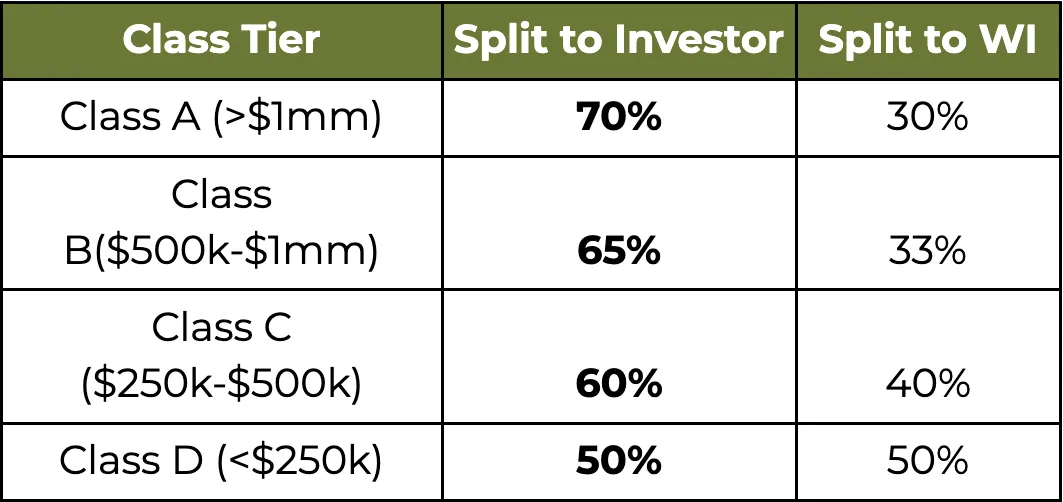

Preferred Return

There is an 8% preferred return associated with the Fund. Any performance up to 8% goes entirely to the investors. Returns above 8% are split according to their class membership (as displayed below), aligning our interest with investors.

Post-Pref Split Tiers

Lock-Up Period

Unlike traditional apartment investments with a long hold period of 7-10+ years, the Worcester Fund only has a 4-year lock-up period, offering investors an opportunity to exit the investment thereafter at a time of their choosing.

Fund Strategy

We follow a conservative acquisition approach that heavily emphasizes buying attractive multifamily properties below their intrinsic market value and private loans in a conservative loan-to-value (LTV) position. We leverage long-time relationships, our 120+ employee team, and extensive market expertise to create maximum value from each investment. The Worcester Fund has a first right of refusal on all Worcester opportunities. Since our target returns are 8-12%, the Fund focuses its strategy on loans and equity opportunities that align with or exceed those return expectations.

Private Loan Holdings

Worcester Financial is an asset-based lender offering our investors an 8-12% return on their investment over 12-18 month terms. We like to say, “We only lend on what we would want to own.”

We generally lend up to 70% of the after-renovated value of the collateral. Worcester’s extensive experience as a real estate operator uniquely positions us to get top value from an asset if the borrower defaults. Whereas banks make their best effort to recover collateral, often taking a loss, we’re positioned to finish the project if necessary and obtain top value. The Fund currently has over $11.5M invested today in private loans, generating an average return of 13%.

Equity Holdings

Worcester Investments has transacted on over 6,000 apartment units throughout the Midwest. The Worcester Fund is currently participating in 9 of its equity deals, with plans to increase this number in 2025, expanding into more equity opportunities as they become available.

Fund Asset Breakdown

The Fund provides a well-diversified mix of private loans and equity opportunities. Our private lending concentration makes up 53% of the Fund’s investments, while equity makes up 44%, and cash 3% totaling assets under management of $22M.