10-12% Investor Returns

6-18 Month Terms

Immediate Monthly Distributions

401k + IRA Compatible

Real Estate Backed

PRIVATE LOAN INVESTING

WHAT IS WORCESTER FINANCIAL?

Worcester Financial is an asset based, hard money lender offering our investors an average return of 10% on their investment. Our loans are short term and generally do not exceed 18 months. The loan is collateralized by real estate or a physical asset.

We generally lend up to 70% of the after renovated value of the collateral. Our team underwrites the opportunities in-house and evaluates the risk based on borrower history and market conditions. Upon approval from our underwriting group, we send the opportunity to investors, allowing them to participate as a co-lender.

Worcester Financial acts as the Servicing Agent for all of our loans and ensures that monthly payments are received from the borrower and sent directly to the investor’s account. In the event of a default, Worcester Financial will manage the foreclosure and collection of any losses on behalf of the Investor.

Worcester Financial is compensated by a combination of origination fees paid by the borrower at closing as well as a monthly servicing fee. The monthly servicing fee helps cover the cost of managing the loan portfolio and administrative expenses.

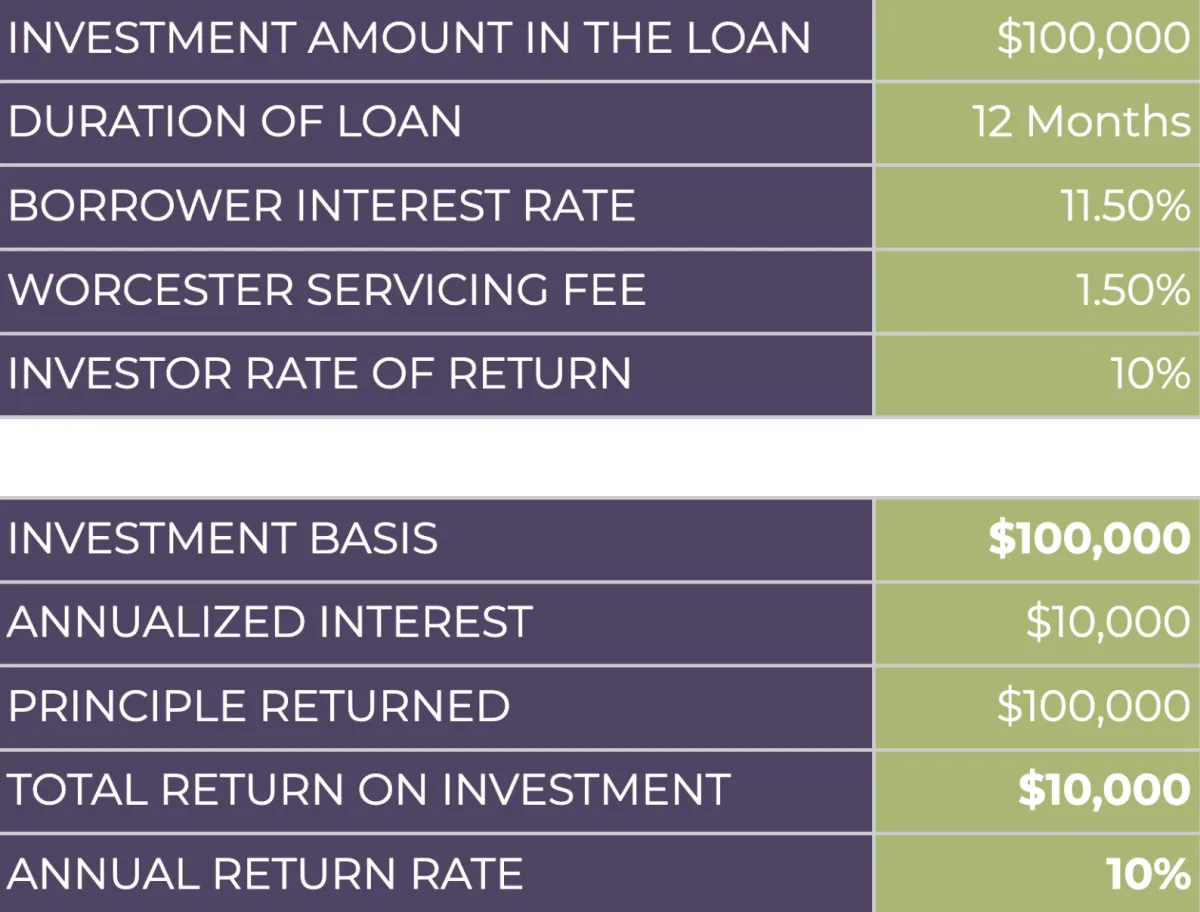

The servicing fee generally does not exceed 2% annually. For example, if the borrower is charged an annual percentage rate of 11%, 9.5% is paid to the investor group and 1.5% is retained by Worcester Financial as a servicing fee. Loan Servicing and management is a benefit to the Investor but is always paid by the borrower.

WHY WE STARTED WORCESTER FINANCIAL

We started Worcester Financial in 2016 after consulting with a lifelong investor and friend who successfully operated a private

lending company.

He pointed out that our existing business model had about 80% of the infrastructure needed to run a successful private lending

business. We already had an acquisition team and a growing property management company. Unlike traditional financing, we

had all the tools needed to retain an asset and recover losses in the event of a default.

From the beginning, our philosophy has been to only lend on assets that we are comfortable owning. We have extensive

experience within the Real Estate and lending industry and when faced with the worst case scenario, our team is equipped with

the resources to not only take back the asset but also have the ability to complete the project and sell it.

WHAT IS THE RISK PROFILE OF INVESTING IN HARD MONEY LOANS?

Private lending is an excellent option for someone looking for passive income they can rely on monthly. Like any investment, there

is still risk associated with these types of loans. If the borrower cannot repay the loan, we foreclose on the collateral and liquidate it.

WHAT TYPES OF PROPERTIES DOES WORCESTER FINANCIAL LEND ON?

Bridge Loans

A bridge loan is typically used when a borrower needs to secure financing quickly. Bridge loans are short term options for borrowers

who need time to obtain traditional financing or sell an asset.

Fix and Flip Loans

This is our most common loan

product. A borrower purchases

an asset at under market value,

makes improvements and sells

the rehabbed property for a profit.

BRRR Loans

BRRR is an acronym for Buy, Rehab, Rent, Refinance. BRRR loans are for borrowers who plan to hold the real estate after the rehab and then the borrower refinances the property through traditional financing once it is rented and stabilized.

Investment Example