Parkview Townhomes

Below is an real life example of what you would receive as an investor evaluating this deal.

We’re happy to share the latest updates on Parkview Townhomes, a 126-unit duplex and four-plex townhome community located in Wichita, KS. Since introducing this opportunity, we are now over 65% subscribed in soft reservations, with approximately $1.8M of equity still available. ($4,028,000 reserved out of a total of $5,901,962)

We're excited to offer improved return structures for current and prospective investors in this deal. As we have a few projects and commitments in the pipeline, we're motivated to close this opportunity quickly and are pleased to extend more favorable terms as a result. Details can be found below, along with an updated closing timeline, a deal summary video, and an underwriting walkthrough video.

DEAL SUMMARY

DEAL SUMMARY VIDEO recorded by Jesse Worcester, Co-Founder and Partner of Worcester Investments. In this video, Jesse summarizes the investment opportunity and walks through the key data points, story of the deal, potential challenges, and how we plan to overcome them, as well as what we like most about this opportunity and why we believe it’s a good investment.

UNDERWRITING WALKTHROUGH VIDEO recorded by Bryn Charsley (VP of Acquisitions), where he walks through the underwriting model and stress tests multiple market scenarios.

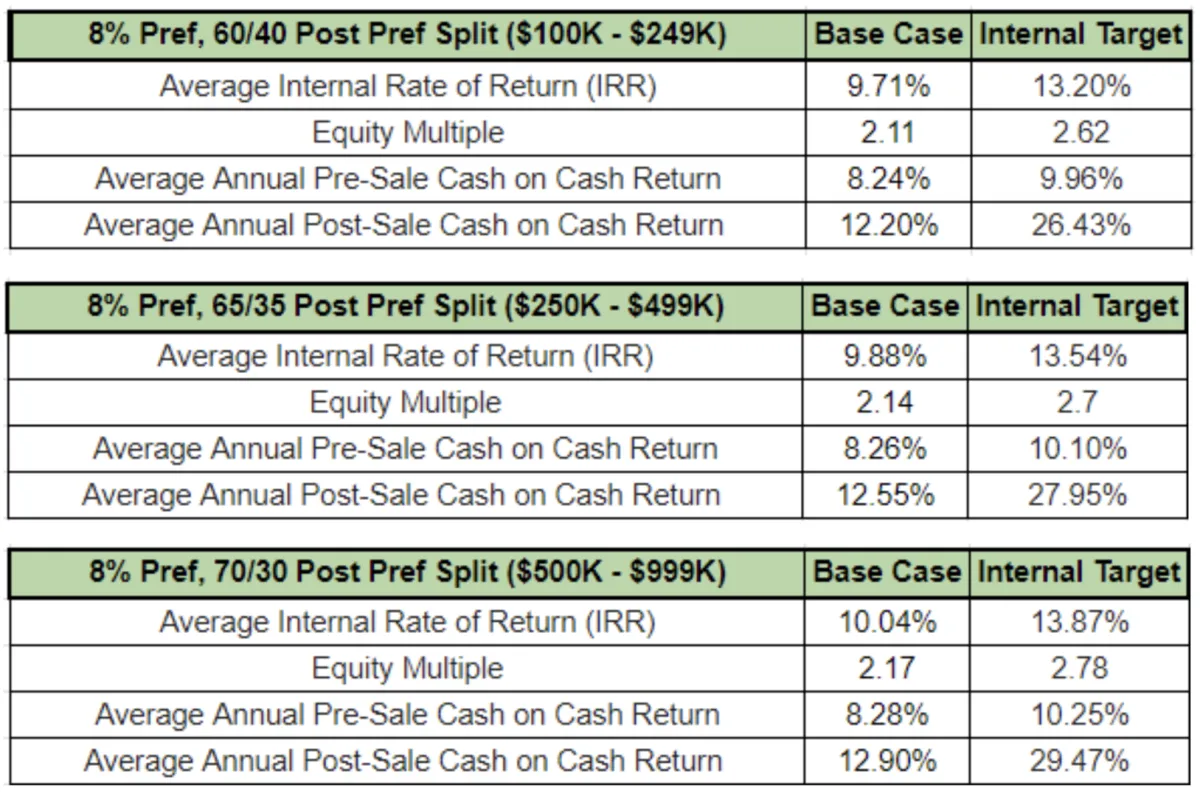

Tiered Return Structure

$50k - $249k: 8% preferred return, 60/40 post-pref split

$250k - $499k: 8% preferred return, 65/35

$500k+: 8% preferred return, 70/30 split in favor of the investor

Investor Returns

$50k Minimum investment

8% Preferred Return to Investors

8.24% - 10.25% Before-Sale Cash-on-Cash Return (COCR)

12.20% - 29.47% After-Sale Cash-on-Cash Return (COCR)

2.11x - 2.78x Equity Multiple

9.71% - 13.87% Internal Rate of Return (IRR)

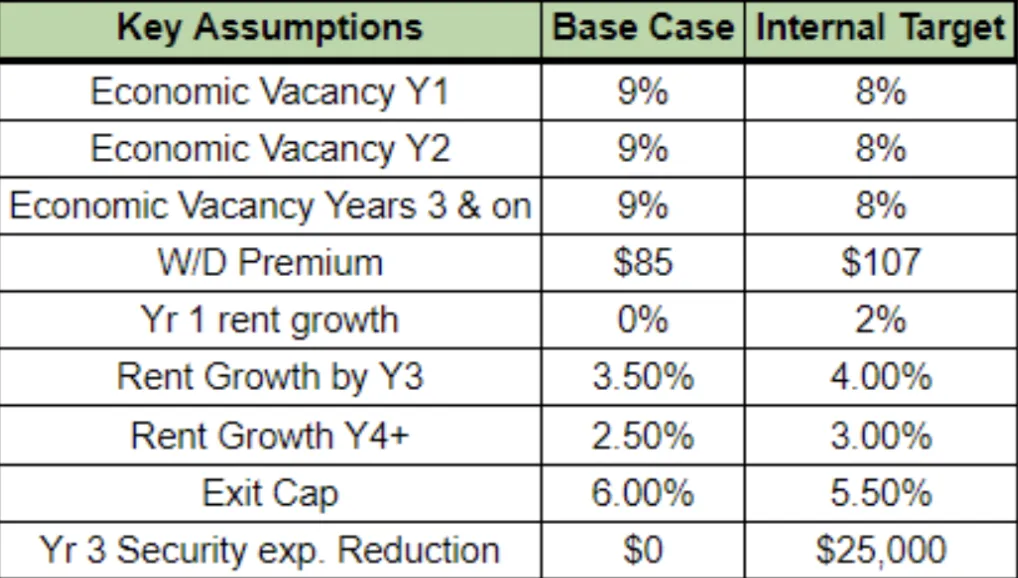

ASSUMPTIONS

Below are the links to the underwritings representing the base case and internal target scenarios.

Direct Seller Relationship

We have transacted successfully with the current owner in the past, visited them in their HQ state of Pennsylvania, and pursued a mutually beneficial partnership/relationship knowing they were/are likely to continue selling off their 1,000+ units in Wichita. Their business plan is to purchase properties, create a path to add value, increase occupancy, and sell the asset within 3-5 years, leaving “meat on the bone” for operators who emphasize longer hold periods and cash flow. The seller ultimately awarded us the deal, in part due to our existing relationship and success of our previous closing in 2023 (Westlink Village).

Economies of Scale

Our team has an established presence, and economies of scale, in Wichita. We view this asset similarly to our Lakeside Townhomes project (see below), which has exceeded the net income pro forma to date by 0.88%. Our other Wichita asset, Westlink Village (closed in 2023), is also on track with early pro forma projections.

Lakeside Townhomes - Purchased in 2020 (138 Units) Actual To-Date Annual Cash on Cash: 9.26%Pro Forma To-Date Annual Cash on Cash: 8.38% Westlink Village - Purchased in 2023 ( 240 Units)Actual Year-1 Cash on Cash: 3.77%Pro Forma Year-1 Cash on Cash: 3.64%

BUSINESS PLAN

Summary

Our business plan is to add a supplemental loan at closing, improve the property through a light capex program (see below), add washers/dryers to remaining units, and operate the property “as-is” (the property is already stabilized and in overall great condition).

Low-Interest Debt

We are assuming the asset’s current loan at an interest rate far lower than the market (3.10%). Given the property's current LTV position, we will be able to add a supplemental loan at the property's closing, maximizing cash flow and returns.

Assumable loan interest rate = 3.10%

Blended interest rate with supplemental loan = 3.85%

Remaining loan term = 7 years

Loan To Cost before supplemental loan = 58.82%

Loan To Cost after supplemental loan = 71.24%

Minimal CapEx Required

This asset is in good condition overall and requires minimal capital improvements.

Built-in 1991

All roofs and windows replaced in the last 2-10 years.

The planned renovations are primarily cosmetic, including updating the paint, tub resurfacing, and appliance replacements in some units.

The total CapEx is $480,050 or $3,810 per unit, which includes washer/dryer installations.

Washer/Dryer Additions

Upon purchasing a property, we often add washers/dryers to each unit. In this case, the property already has in place W/D connections, and the seller has already begun executing this business plan.

The owner has already achieved an average rent premium of $107 on over 50% of units.

We are underwriting a $85 premium to be conservative in our base case underwriting.

Housing Partnerships

The current owner has built partnerships with several housing voucher/assistance programs, with 28% of the asset’s tenants specifically utilizing housing vouchers. While there are potential reputational/perception risks associated with accepting housing, we are comfortable with these programs as they are subject to the same screening process as market-rate renters. Program residents also have added motivation to comply with lease terms, as any violations or missing rental payments could lead to complete removal from the program and loss of their assistance. In Kansas (unlike some other states), voucher payments are made directly to the property, which benefits Parkview.

Security

Parkview is situated at a transition point between Lambsdale, a Class-A neighborhood with a median home value of $290K, and Ken-Mar, a Class-C/D neighborhood where the median home value is $96K. Given its proximity to a lower-income area, the property has dealt with crime in the past. However, we feel this has been effectively addressed through the addition of full-time onsite security, surveillance cameras on each building, and wood-panel fencing around the property. These measures have resulted in zero criminal incidents over the past 12 months.For more detailed information on the property and our business plan, please see the link to the property package below.