52.31% ROI on full-cycle deals

16.77% Average Annual COCR

29.05% Average ROI

Multifamily Direct Equity Investments

Direct Equity Investments into Multifamily real estate provide investors direct ownership into one of the most stable and economically resilient asset classes in real estate. By partnering with Worcester Investments (WI), purchase a piece of equity into individual properties – Realizing all the benefits of real estate including cashflow, equity upside, and tax incentives - without the hassle of managing the asset on their own.

WHY MULTIFAMILY?

Multifamily housing addresses one of the most fundamental human needs: shelter. Coupled with the increasing demand for affordable housing and rising mortgage costs, multifamily has proven to be a highly resilient, predictable, and stable asset class. This is why we have dedicated the past 16 years to operating within this space.

Multifamily investments offer consistent cash flow and strong upside potential, making them the preferred asset class for many investors, especially during economic downturns. In recessions, homeownership often declines as credit tightens and uncertainty grows, leading to increased demand for rental properties. Multifamily housing thrives on this steady demand, ensuring reliable income streams.

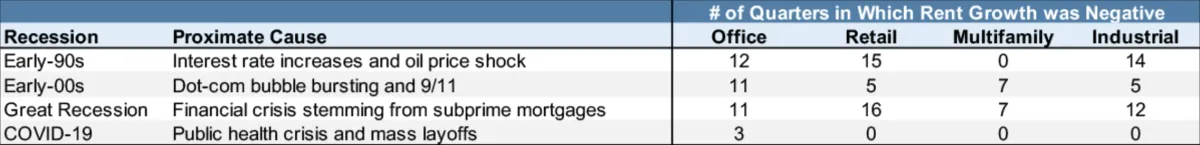

The chart below illustrates how multifamily housing has consistently performed across the last four recessionary periods.

WHY THE MIDWEST?

WI purchases assets in Kansas City and the surrounding 500 mile radius. We like to be within a days drive and back from all of our assets. This markets happen to be some of the most resilient and stable markets in the country to own real estate in. Income to cost of living ratios are well above national average, the labor markets are diverse, housing is affordable, and the population growth numbers are strong.

These market's are well insulated from the major crashes we see along the costs or in other "hot"markets, making them ideal for long-term investments in the region.

HOW DOES WORCESTER MAKE MONEY?

Most real estate syndicators rely on fee revenue as a primary profit center in their business model. This means that, regardless of how well an investment performs, they still generate profit from fees. At Worcester Investments, we take a different approach. We do not use fees as a profit center. Instead, any fees charged are designed solely to cover operating expenses and overhead, with the goal of making fees a break-even item for us. As a result, our acquisition, management, and disposition fees are well below typical market rates.

Rather than relying on fees, we align our interests with those of our investors by participating only in the upside performance of a deal through a preferred return structure. This approach encourages us to be more conservative in how we buy, manage, and sell investments. If a deal underperforms, we believe it is only fair for Worcester Investments to share in that experience alongside our investors.

PREFERRED RETURNS STRUCTURE

Our investments operate on a preferred return structure, ensuring that Worcester Investments is only compensated when the investment performs above the preferred return threshold.

Here’s how it works: If a deal offers a 7% preferred return, the first 7% of annual returns go directly to investors before Worcester shares in the equity benefits. Returns exceeding the 7% threshold are then split—typically starting at a 50/50 ratio—between investors and Worcester. This is referred to as a post-pref split.

If the deal falls short of the 7% preferred return in any given year, the shortfall accrues in favor of the investors. In subsequent years, Worcester must first make up the accrued balance before participating in the deal's returns.

This structure remains consistent throughout the investment period, including the sale. If the preferred return has been met during ownership, proceeds from the sale will also be split between investors and Worcester according to the same structure. This alignment of interests ensures that investors' returns are prioritized.

TIERS

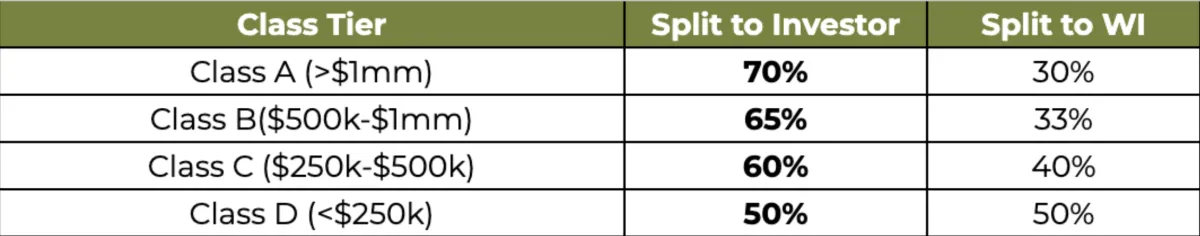

On most of our deals, we incentivize larger investments by offering a post-pref split tier structure. Please see the example below.

LONG TERM HOLD STRATEGY

Worcester approaches underwriting deals through the lens of, "Would we love this deal if we held it for 10+ years?" This guiding question ensures that we are confident in both the long-term debt terms and cash flow—two critical factors for achieving a strong exit sale. By focusing on these elements, we avoid over-reliance on external variables like economic shifts, cap rates, and interest rate fluctuations, which are beyond our control.

We identify significant risk in deals structured for the short term, as they often require short-term debt. This creates heightened interest rate risk if the property cannot be sold within the expected timeframe.

Our long-term hold strategy positions us to take advantage of strong early sale opportunities without the added pressure and risks of adhering to a strict timeline. This flexibility ensures stability and maximizes potential returns.