Diamond Club Apartments

Below is an real life example of what you would receive as an investor evaluating this deal.

We’re excited to share that we just went under contract on a new investment opportunity, the Diamond Club Apartments. We are acquiring this beautiful 120-unit, 2008-built apartment community in Warrensburg, MO, for just $87,917 per unit.

The deal was negotiated off-market through a direct-seller relationship, has in-place average rents of $1,258 per month (far exceeding the “1% rule”), and offers investors strong cash flow and significant upside potential (see projected returns below).

DEAL SUMMARY

DEAL SUMMARY VIDEO recorded by Jesse Worcester, Co-Founder and Partner of Worcester Investments. In this video, Jesse summarizes the investment opportunity and walks through the key data points, story of the deal, potential challenges, and how we plan to overcome them, as well as what we like most about this opportunity and why we believe it’s a good investment.

Tiered Return Structure

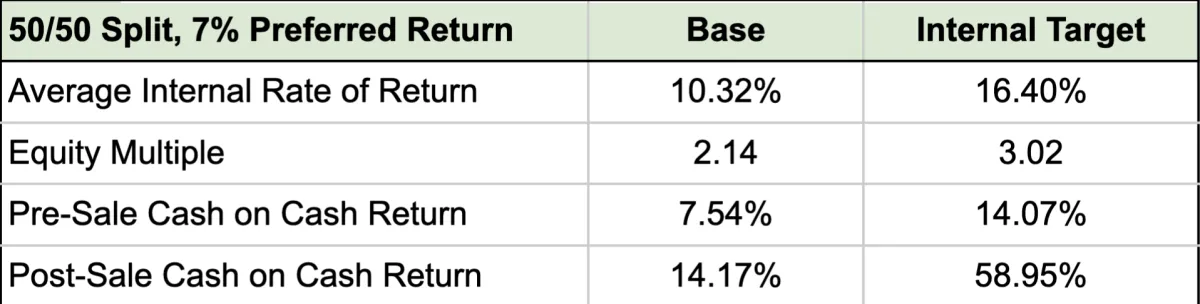

$100K - $499k (7% preferred return, 50/50 post/pref split)

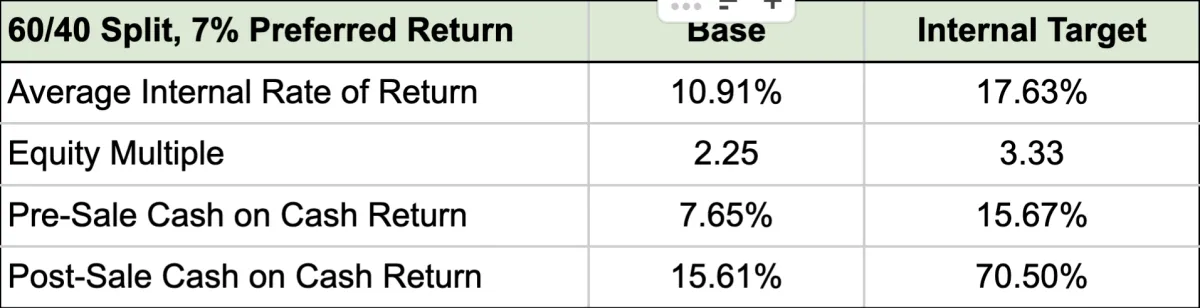

$500k+ (7% preferred return, 60/40 post/pref split)

Investor Returns

7% Preferred Return to Investors

7.54% -14.07%+ Before-Sale Cash-on-Cash Return (COCR)

14.17% - 58.95%+ After-Sale Cash-on-Cash Return (COCR)

2.14+ - 3.02+ Equity Multiple

10.32%+ - 16.40+ Internal Rate of Return (IRR)

ASSUMPTIONS

Below are the links to the underwritings representing the base case and internal target scenarios.

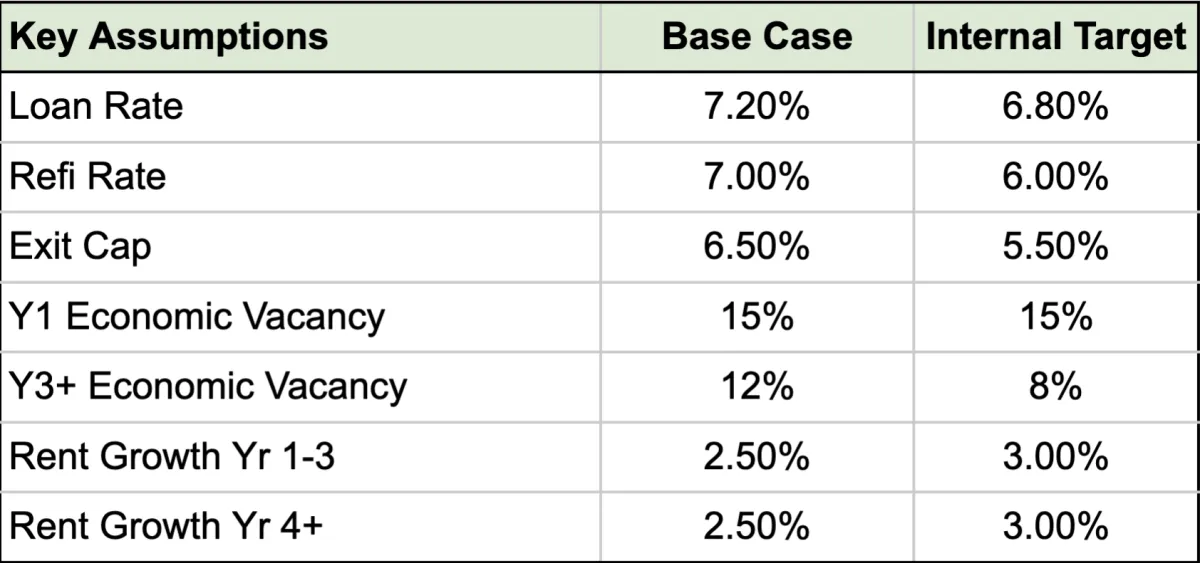

Debt Terms

We intend to close the property with a local bank loan. In the base case, we have underwritten the loan at a 7.20% interest rate, but if we were to close today, the effective rate would be 6.76%. The bank loan will have 24 months of interest only, a 5-year term, and will amortize over 25 years.

BUSINESS PLAN

Summary

The current ownership group’s initial strategy was to reduce the percentage of student-residents (something they had successfully done on a different asset in the past). Yet the strategy was not successful on Diamond Club, and the property is now in a limbo/hybrid state (not targeting any specific demographic).

Given its proximity to campus, we believe the primary strategy for the property should be to maximize its appeal to students (leveraging its strongest attributes), while also offering a great option for non-residents. To execute this business plan, we will implement the following strategies.

Rent-By-The-Bed: The current operator does not offer a rent-by-the-bed option. The asset is a mix of two—and four-bedroom apartments. For a student to rent a four-bedroom apartment, they would need to bring two to three roommates with them to make it make sense. Renting by the bed will solve this problem. The current management team stated that during the summer, they get one to two requests per day to rent by bed (their two-bedroom units lease quickly and are 98% occupied, leaving only four-bedroom units remaining).

Strategic Lease Expirations: We will reposition all leases to expire simultaneously (at the end of July) to align with the school's academic calendar (as opposed to staggering lease expiration dates as they exist today). This will enable us to lease all apartments while students search for a home for the next school year. We will add temporary leasing staff from March through August to ensure we stay ahead of the peak leasing season. Modernize Kitchens: Although the property is in overall great condition and requires little capital improvement, we intend to do a light value-add program with new flooring and countertops. All 120 units have seafoam green Formica countertops, which will be upgraded to a neutral color. We will also replace the flooring in 61 units (the seller has already replaced the floors in approximately half of the units).

Economic Vacancy: To be conservative, in our base case underwriting (see below), we assumed 15% economic vacancy in year one and 12% in years 3+. In 2022, the trailing-12 average occupancy was 91%; in 2023, 85%, and the current occupancy ending June is 80% (they are working on leasing up for the fall 2024 semester). Our base scenario assumes we continue to operate the property with similar vacancy as they have historically; however, the average vacancy in the Warrensburg market is 8.6%, and we expect our business plan of repositioning lease terms and offering a rent-by-the-bed option to have significant upside potential (see internal target scenario below if we achieve 8% average vacancy).

Refinance Year 5: Our business plan assumes a year-five refinance to agency financing. When refinancing, we expect to return 25% of the original capital invested and catch up any remaining portion of the accrued preferred return. In our base case, we have underwritten a 7% rate (similar to our original loan), 12 months interest only, a 5-year term, amortizing over 30 years.